Flex Space to increase 50% in four years

In its annual UK Market Research Report, The Instant Group’s data shows that demand for flex space across the country is up 22% in the last 12 months. Regional cities – such as Leeds and Manchester – are leading the way in this increase but the latest market data shows a recovery in central London.

The size of the space being taken with flex operators has also increased by 44% since the pandemic as larger companies incorporate more flexible workspace in their real estate portfolios.

With demand for flexible space eclipsing pre-pandemic levels, the result is that the supply of new centres is growing and diversifying at a rapid rate. New supply is primarily coming from traditional landlords. GPE has announced that it aims to grow its flex offering from 13% to 25% of their total portfolio by 2027, and CBRE have taken over 40% of Industrious to boost their flex product. Many other landlords are already following suit, shaking up the flexible landscape in the UK.

Supply of new workspace grew at 5% throughout the pandemic but that rate of growth is expected to double this year. The number of flex spaces will double by 2026 and account for more than 150m sq ft of office space in the UK, or 10% of total UK office space.

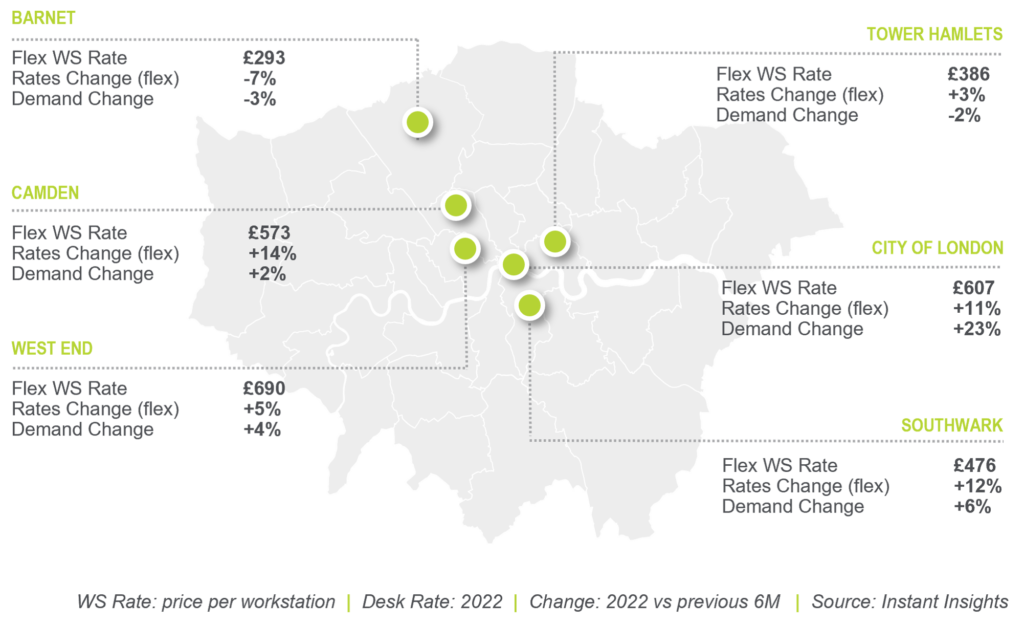

Despite the increase in supply, average workstation rates are up 4% on H2 2021, currently averaging £408 pcm across the UK. This is primarily due to demand in major cities picking up as well as operators increasing rates to cover inflationary costs.

Lucinda Pullinger, UK Managing Director, The Instant Group, said: “Flex space is now a critical component of most companies’ office strategy. Hybrid working has entrenched the role of serviced offices, coworking and meeting rooms. After the ups and downs of the past two years, it is very exciting to see growth in markets such as central London again.

“However, we would sound a note of caution that recessionary fears are likely to see some organisations put their office moves on the back burner in H2 as they watch the wider macro-economic picture play out. With more landlords entering the market in the next 24 months, there will be an increase in supply to meet current demand levels with the flex market set to become an increasingly competitive market.”

Instant’s data is based on its market leading flexible workspace platform which placed customers in flexible workspaces in over 225 cities and towns across the UK in the last 12 months.